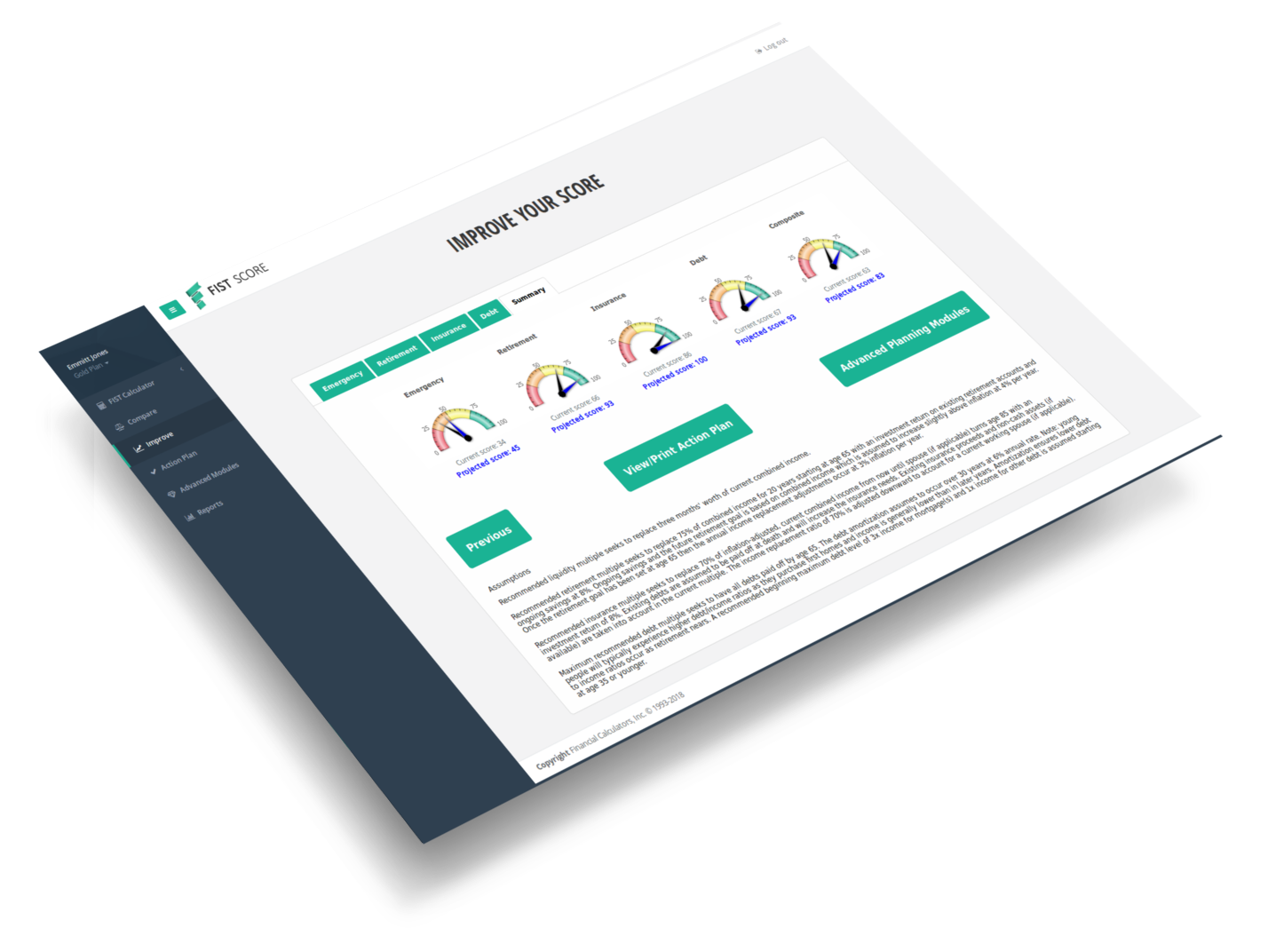

Gauging your financial health is much more complex than just determining your credit score. While FIST® considers your current debts, similar to a credit score, it also takes into account your retirement savings, life insurance, and emergency savings. Stability in each of these areas is necessary for long-term financial security and the peace of mind it brings to you and your loved ones.

After assessing your scores in each of the four areas, FIST® also gives you a composite financial stability score on a scale of 0-100. With FIST®, you can take control of your financial destiny by setting and tracking short and long-term financial goals. Improve your score as you achieve your goals and progress towards financial stability and generating wealth. Monitor your net worth, budget household and personal expenses, and track your investments all in one place. Connect your financial accounts from over 13,000 financial institutions for a comprehensive personal finance dashboard that will provide you with AI-driven insights to enable clear and informed financial decisions.

Improve your financial stability with an easy to use, all-in-one financial wellness tool. Calculate your FIST® Score now by answering a few simple questions below.

Financial stability is nothing more than good risk management. The main areas of financial risk that often impact families can be summarized by the four L's:

No need to worry. Introducing the FInancial STability (FIST®) index. Simply answer a few easy questions and you will be able to get an instant snapshot of your financial risk exposure in these four areas: retirement, protection, liquidity and debt management. The sophisticated mathematical engines will quickly identify areas you need to improve. Similar to a credit score, your FIST® score will give you a gauge of your overall financial health on a scale of 0-100. Review the recommendations section to see how you can improve your category and composite scores. Come back often and watch your score improve with the actions you take and compare your score to others. No more procrastinating! You can do this! Today is the time to identify your financial risks and take steps to become financially stable!

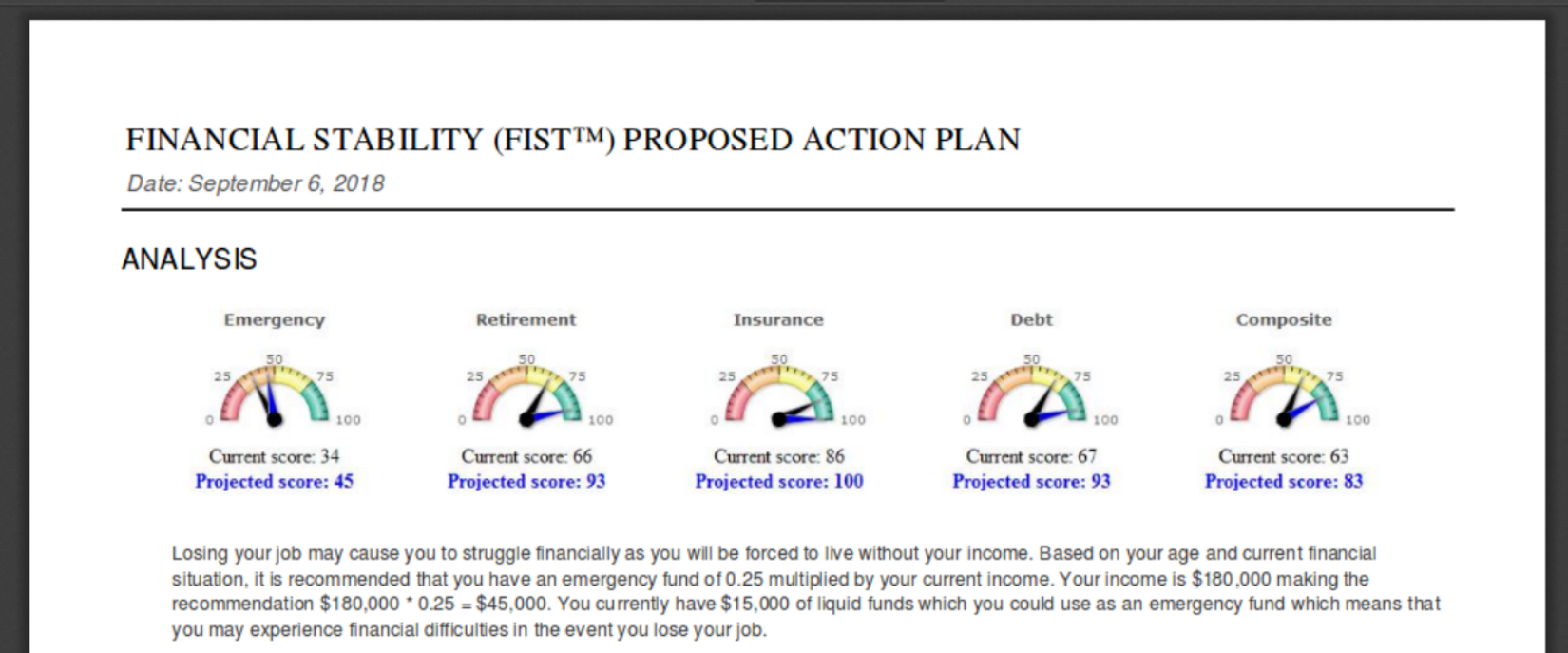

This information may help you analyze your financial needs. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy. Hypothetical illustrations may provide historical or current performance information. Past performance does not guarantee nor indicate future results.

Financial Stability is nothing more than good risk management. While we may not be able to choose when life's challenges head our way, we can be prepared for the financial repercussions they may bring. The main areas of financial risk that often impact families can be summarized by the four L's. How are you doing in each area?

Without enough money set aside, the loss of a job, an unforeseen medical event or unexpected home repair can cause a significant strain on your finances. Adequate savings set aside for an emergency will keep your head above water when a crisis hits home.

Taking on too much debt can be debilitating to anyone seeking a financially secure future. High monthly payments and added fees not only cause significant emotional and financial strain, it also significantly limits your ability to save money for emergencies or for retirement.

While you may dream of the day of your retirement, without proper planning, that day may need to be pushed further and further back into an unknown future. Saving consistently and sufficiently for retirement will allow you to determine when and how you retire.

One of the largest financial burdens that can be placed on a family is the failure to have an adequate life insurance policy in the event of the death of a primary care giver and/or provider. Life insurance is a necessity for anyone who has others who depend on them for their financial well-being.

While we don't store any financially sensitive data like your bank account number or social security number, we still take your financial information seriously. Industry-standard methods are in place to keep your information safe.

Our financial engines have been running for over 25 years and have been vetted by many of the top financial institutions around the globe.

The FIST® web application is fully responsive. Wherever you are, you can rest assured that your FIST® account can be easily accessed and displayed on whatever device you have.

You're in good company. Millions of people each month make financial decisions using our tools. In fact, there's a good chance you have already done so, maybe without even knowing it!

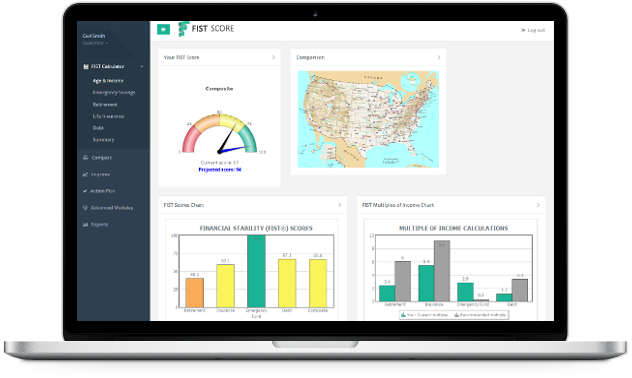

The FIST® application is full of awesome features! At no charge to you, you can save your information and return to see the progress you are making, as well as compare your FIST® score with others in your area. For a small fee, our Standard and Premium subscriptions allow you to improve your score as well as create and save an individualized action plan with email notification reminders. Be sure to check out our advanced planning modules with access to personalized help only a click away.

We know that personal finance is complex, and change happens over time. We aren't here just to give you a score, but to help you build and sustain an individual action plan customized to meet your financial goals. We assist you in determining what progress needs to happen in each area to build a solid and detailed path forward.

There is strength in numbers. With our purchasing power and product knowledge, we are able to find the best deals for you on financial products like credit cards, CDs, mortgages, savings accounts, life insurance and many more. Since we are not beholden to any financial institution and do not draw commissions, you can rest assured that you will receive unbiased advice and appropriate links to product solutions that will help improve your FIST® Score.

Our Premium Plan includes access to our Advanced Planning Modules, giving you access to the same tools that financial advisors use to create detailed financial plans for their clients.

We'd love to hear from you with any questions or suggestions you may have.

At Financial Calculators, Inc. we have been providing financial tools since 1993. We measure our success by the success of our customers. We operate under a philosophy that customer service is above all else the founding principal of strong long-term relationships. Our commitment is to maintain the highest level of customer service that our company can provide.

Or follow us

© 2025 Financial Calculators Group, LLC.

"Simplicity is the ultimate sophistication." - Leonardo Da Vinci